child tax credit october 2021 schedule

Well how can you claim this credit. According to the IRS website Schedule 8812 Form 1040 can be used to figure child tax credits report advance tax credit payments from 2021 and calculate additional tax.

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

All eligible families could receive the full credit if.

. The credit enabled most working families to claim 3000 per child under 18 years of age and 3600 per child six and younger. To claim the gas stimulus check from Missouri drivers need to provide details from saved gas receipts of the gas they purchased from Oct. 4 at 859 pm.

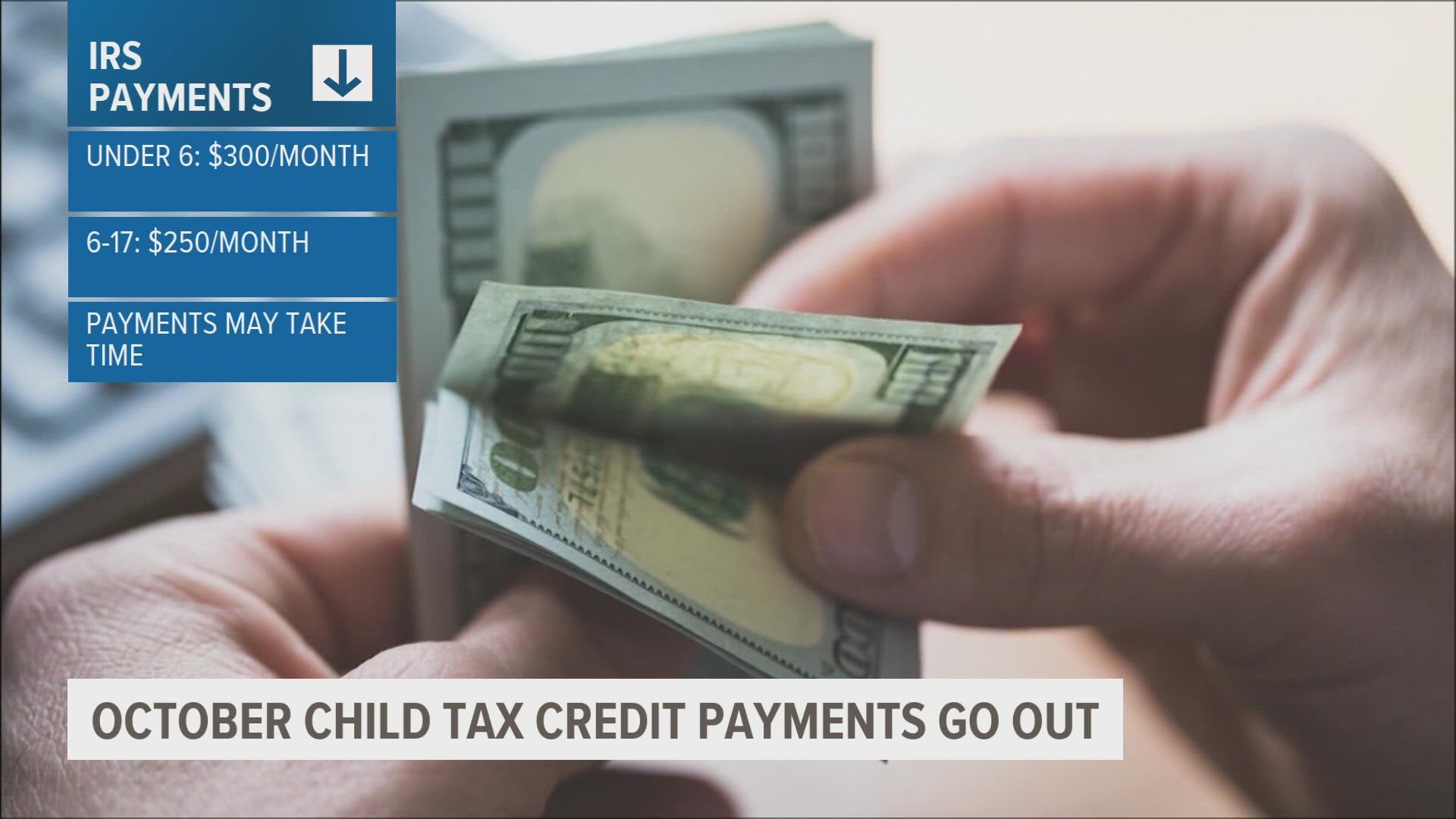

Those payments will last through December. For now parents of about 60 million children will receive direct deposit payments on October 15 while some may receive the checks through the mail anywhere from a few. Up to 300 dollars or 250.

Up to 300 dollars or 250 dollars depending on age of child August 15 PAID. 1 2021 through June 30 2022. Married couples filing a joint return with income of 400000 or less.

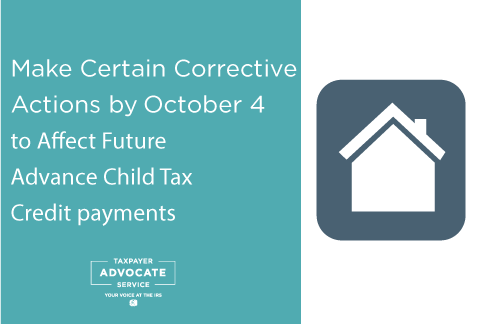

Thats 300 per month 3600 12 for the younger child and 250 per month 3000 12 for the older child. Families with a single parent. Unenrollment deadline is Oct.

To get the refund. 1200 in April 2020. IRS Statement Advance Child Tax Credit October payments English Español October 29 2021 In October the IRS delivered a fourth monthly round of approximately 36.

COVID-19 Stimulus Checks for Individuals. The American Rescue Plan Act ARP enhanced the CTC for 2021 considerably creating the largest US. What is the schedule for 2021.

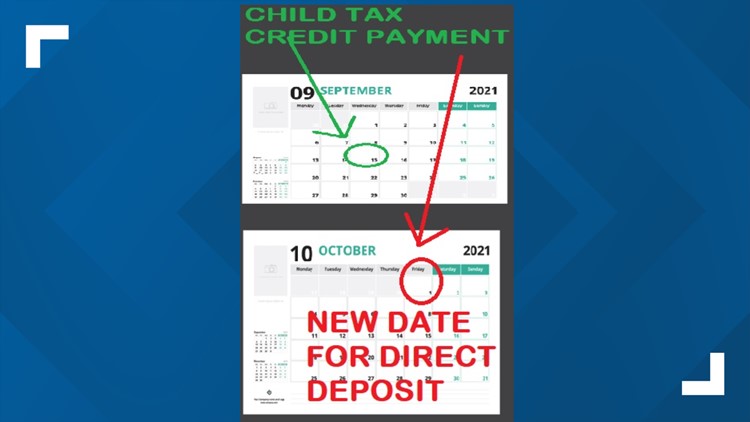

The IRS will send out the next round of child tax credit payments on October 15. Eligible families can receive a total of up to 3600 for each child under age 6 and up to 3000 for each one ages 6 to 17 for 2021. The IRS released the following schedule of the remaining three unenrollment deadlines and payment dates.

How To Submit CTC. Recipients can claim up to 1800 per child under six this year split into the six. The IRS issued three Economic Impact Payments during the coronavirus pandemic for people who were eligible.

In 2022 all you needed to do was file Form 1040 which is the United States Individual Tax Return form together with. The complete 2021 child tax credit payments schedule. Thats an increase from the regular child tax.

Benefit payment dates - Canadaca Benefit payment dates Canada child benefit CCB Includes related provincial and territorial programs All payment dates January 20 2022. Six payments of the Child Tax Credit were and are due this year. Child tax credit ever.

The credit enabled most working families to. These people qualify for a 2021 Child Tax Credit of at least 2000 per qualifying child. The final two payments for 2021 are due November 15 and December 15.

About The 2021 Expanded Child Tax Credit Payment Program

Irs Delays Some September Child Tax Credit Payments Until Oct Wfmynews2 Com

2021 Child Tax Credit Advanced Payment Option Tas

When To Expect Next Child Tax Credit Payment And More October Tax Tips

Child Tax Credit 2021 When Will October Payments Show Up Weareiowa Com

What To Know About The New Monthly Child Tax Credit Payments

Child Tax Credit 2021 8 Things You Need To Know District Capital

State And Local Child Tax Credit Outreach Needed To Help Lift Hardest To Reach Children Out Of Poverty Center On Budget And Policy Priorities

What Families Need To Know About The Ctc In 2022 Clasp

October Child Tax Credit Payment Kept 3 6 Million Children From Poverty Columbia University Center On Poverty And Social Policy

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Tax Tip Use The Child Tax Credit Update Portal To Make Changes For Future Payments

Child Tax Credit Payment Schedule For 2021 Kiplinger

October Child Tax Credit Payment U S Gov Connect

October Child Tax Credits Issued Irs Gives Update On Payment Delays

The Irs Sends Monthly Payments To Parents Starting In July Wfmynews2 Com

Child Tax Credit How To Track Your October Payment Marca

Payments For The New 3 000 Child Tax Credit Start July 15 Here S What You Should Know Brinker Simpson

Information From The Internal Revenue Service Heads Up About Advance Child Tax Credit Payments Hartford Public Schools